The myth of affordable private health care insurance for individuals

By Tim Montgomery

There's a popular myth going around that private health care insurance can be affordable for individuals who are seeking coverage outside a group plan. Nothing could be further from the truth.

There's a popular myth going around that private health care insurance can be affordable for individuals who are seeking coverage outside a group plan. Nothing could be further from the truth.

Insurance is a risky business. To be more specific, it is the transfer of risk, or the possibility of loss, from an individual to an insurance company. But insurance companies are business ventures, like any other business ventures, that rely on turning a profit - not risking a loss.

To be profitable business, health care insurance relies on the law of numbers, i.e. a large resource pool of premium inputs to cover the expense of individual claim payouts. A larger pool of insureds means greater cash input and greater likelihood that the collected premiums will outpace claims, more so with a small investment in proactive group health measures - opportunities to promote good health among groups of insureds, such as discounts on health club memberships and awarding and encouraging healthy habits.

Insurers manage the risk of loss through a transfer that spreads that risk among thousands, or even millions of insureds. They depend on the probability that not everyone will experience an accident or health crisis while they own an insurance policy. In this way, the large number of insureds who do not have an accident or crisis will be paying for the losses of the few who do - and insurers can make a profit. This is the only way that insurance can work as a business.

What the Affordable Care Act or "Obamacare" has attempted to establish in creating health care exchanges and mandating coverage is a group basis for insuring individuals who are outside a group plan. And there are more and more individuals in this category as we move to an economy of increased work outsourcing, more small businesses and greater numbers of self-employed and contract workers. By making health care insurance mandatory for all and by subsidizing premiums for those in need who signed up for insurance through a health care exchange, the hope was to create a large enough pool of insureds to make the risk more acceptable to insurers and to make premiums more affordable to individuals. This, while preserving the concept of private health care insurance as a business.

This pooling of insureds and subsidizing of health care insurance premiums is what larger employers accomplish in establishing group plans and in contributing to the employee's premium payments. In doing so, they create a business opportunity for insurance companies while making more affordable health care a benefit to their employees. Health care exchanges are the equivalent of employer-provided group health care to those outside a group plan. With some restructuring and greater regulation, government subsidized health care exchanges could take the place of employer-based group health care plans and be the basis for a strong multipayer national health care insurance system.

Medicare is an example of a current system that uses taxation to help pay for health care insurance, and the health care exchanges created by the Affordable Care Act provide a means to deliver affordable health care to a wider clientele. Instead of subsidizing only those with incomes in a lower tax bracket, however, irrevokable subsidies should be available to all. Like Medicare, they should be financed through corporate and payroll taxes. And, like premiums, they should be based on need in terms of risk factors as well as the ability to pay. Until health care costs can be managed, everyone needs a subsidized premium. With greater regulation and caps on premiums and deductibles, the U.S. has a prototype and delivery system already in place for universal comprehensive health care coverage.

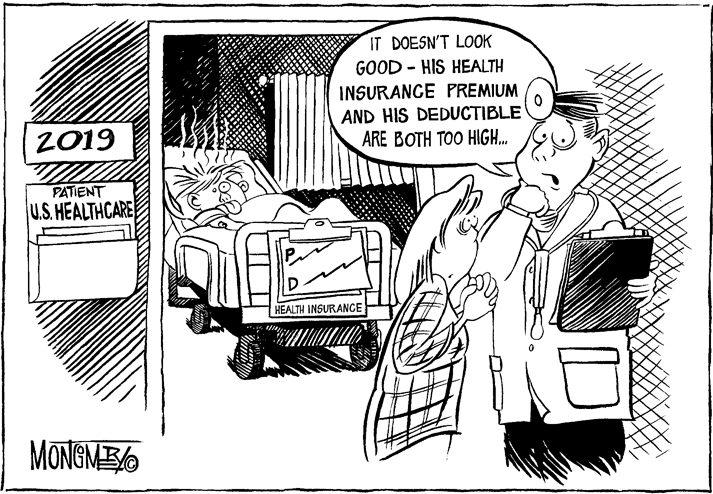

This commentary was published in the River Falls Journal in May of 2019 accompanied by the above editorial cartoon by the author.